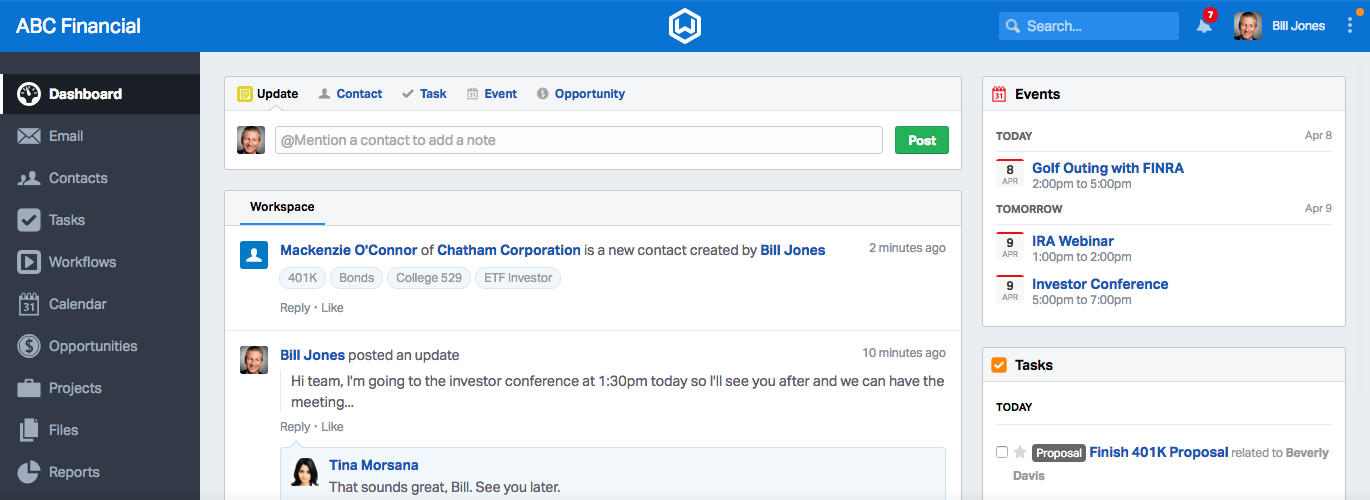

Wealthbox is a cloud-based customer relationship management (CRM) platform designed specifically for financial advisors. It helps advisors manage their client relationships, track their investments, and grow their businesses.

Wealthbox is an important tool for financial advisors because it can help them save time, improve their efficiency, and provide better service to their clients. With Wealthbox, advisors can easily track their clients’ contact information, investment portfolios, and financial goals. They can also use Wealthbox to send automated marketing emails, schedule appointments, and generate reports.

Wealthbox was founded in 2011 by two former financial advisors, Steve Lockshin and Michael Nathanson. The company is headquartered in New York City and has over 100 employees. Wealthbox is used by over 5,000 financial advisors worldwide.

Wealthbox

Wealthbox, a cloud-based customer relationship management (CRM) platform, offers financial advisors a comprehensive suite of tools to enhance their client relationships and streamline their operations. Its key aspects encompass:

- Client Management

- Investment Tracking

- Marketing Automation

- Reporting

- Collaboration

- Customization

- Security

- Integration

- Support

Wealthbox streamlines client management through centralized contact and portfolio tracking, fostering stronger relationships. It empowers advisors to automate marketing campaigns, nurturing prospects and clients effectively. Robust reporting capabilities provide valuable insights into client behavior and business performance. Collaboration tools facilitate seamless teamwork, while customization ensures alignment with unique business processes. Security measures safeguard sensitive client data, and seamless integration with other applications enhances productivity. Comprehensive support ensures advisors can leverage Wealthbox’s full potential.

Client Management

Within the realm of wealth management, client management stands as a cornerstone for fostering enduring relationships and driving business growth. Wealthbox recognizes this imperative, providing a robust suite of tools to empower financial advisors in managing their client interactions effectively.

-

Centralized Client Database

Wealthbox consolidates all client-related information into a single, accessible repository. Advisors can effortlessly track contact details, financial profiles, and communication history, ensuring a comprehensive view of each client’s unique needs and preferences.

-

Automated Communication

Seamlessly nurture client relationships through automated email campaigns. Wealthbox allows advisors to create personalized email sequences based on triggers such as birthdays, market updates, or portfolio performance. This proactive approach keeps clients engaged and informed.

-

Task Management

Streamline daily operations with integrated task management capabilities. Advisors can assign tasks to themselves or team members, set deadlines, and track progress. This ensures timely follow-ups, efficient collaboration, and exceptional client service.

-

Document Management

Securely store and manage essential client documents within Wealthbox. Advisors can upload and organize financial statements, tax returns, and other relevant documents, ensuring easy access and retrieval whenever needed.

By leveraging Wealthbox’s client management capabilities, financial advisors can elevate their interactions, strengthen relationships, and drive business outcomes. The platform’s centralized database, automated communication, task management, and document management tools empower advisors to provide personalized and efficient service, fostering client loyalty and trust.

Investment Tracking

Investment tracking is an integral aspect of wealth management, enabling financial advisors to monitor and manage their clients’ investment portfolios. Wealthbox’s investment tracking capabilities empower advisors to gain a comprehensive view of their clients’ financial positions and make informed decisions.

-

Asset Allocation Analysis

Wealthbox provides robust tools for analyzing asset allocation, ensuring that clients’ portfolios are aligned with their risk tolerance and financial goals. Advisors can assess diversification levels, identify potential imbalances, and make adjustments to optimize returns.

-

Performance Monitoring

Wealthbox’s performance monitoring features allow advisors to track the performance of individual investments and overall portfolios. Advisors can compare returns against benchmarks, identify underperforming assets, and make timely adjustments to maximize growth.

-

Risk Management

Wealthbox incorporates risk management tools to help advisors assess and mitigate portfolio risks. Advisors can conduct stress tests, analyze historical data, and implement strategies to reduce exposure to potential losses.

-

Tax Optimization

Wealthbox supports tax-optimized investment strategies, enabling advisors to minimize tax liabilities for their clients. Advisors can track cost basis, identify tax-loss harvesting opportunities, and make informed decisions to enhance after-tax returns.

By leveraging Wealthbox’s investment tracking capabilities, financial advisors can gain a deeper understanding of their clients’ portfolios, make informed investment decisions, and proactively manage risk. These tools empower advisors to provide tailored advice and drive optimal financial outcomes for their clients.

Marketing Automation

Marketing automation is a powerful tool that can help financial advisors save time, improve their efficiency, and grow their businesses. Wealthbox integrates seamlessly with marketing automation tools, allowing advisors to automate a variety of tasks, such as:

- Sending out newsletters and email campaigns

- Creating and managing social media posts

- Tracking website traffic and leads

- Generating reports on marketing performance

By automating these tasks, advisors can free up their time to focus on more important activities, such as building relationships with clients and providing financial advice. Marketing automation can also help advisors to target their marketing efforts more effectively, by segmenting their audience and sending out targeted messages.

For example, an advisor could use marketing automation to send out a newsletter to all of their clients who are interested in a particular investment strategy. Or, they could use marketing automation to create a social media campaign that targets potential clients who are looking for a financial advisor in their area.

Marketing automation is an essential tool for financial advisors who want to grow their businesses and provide better service to their clients. By integrating marketing automation with Wealthbox, advisors can streamline their marketing efforts and achieve better results.

Reporting

Within the financial advisory landscape, reporting plays a pivotal role in empowering advisors to convey insights, demonstrate value, and foster enduring client relationships. Wealthbox, as a comprehensive CRM platform, seamlessly integrates reporting capabilities to elevate an advisor’s service offerings.

-

Performance Reporting

Wealthbox enables advisors to generate comprehensive performance reports, providing clients with a clear understanding of their portfolio’s trajectory. These reports encompass insightful metrics, such as investment returns, risk-adjusted performance, and comparative benchmarks, empowering clients to make informed investment decisions.

-

Tax Reporting

Wealthbox streamlines tax reporting by aggregating relevant financial data, enabling advisors to generate tax-related reports with ease. These reports provide a consolidated view of clients’ tax liabilities, deductions, and credits, ensuring accuracy and facilitating timely tax preparation.

-

Client Activity Reporting

Wealthbox offers robust client activity reporting, capturing and presenting client interactions, communications, and transactions. Advisors can leverage these reports to gain valuable insights into client engagement, preferences, and areas for improvement, fostering proactive and personalized service.

-

Customizable Reporting

Wealthbox empowers advisors to create customized reports tailored to specific client needs and preferences. Advisors can select from a range of pre-defined report templates or design their own, ensuring that clients receive the most relevant and meaningful information.

By incorporating these reporting facets, Wealthbox empowers financial advisors to enhance client communication, strengthen relationships, and elevate their service offerings. The platform’s ability to generate insightful and customizable reports not only meets clients’ evolving needs but also positions advisors as trusted guides on their financial journeys.

Collaboration

Within the financial advisory realm, collaboration holds immense significance, enabling advisors to leverage collective expertise and deliver exceptional client experiences. Wealthbox, as a comprehensive CRM platform, recognizes the power of collaboration and incorporates robust features to facilitate seamless teamwork and knowledge sharing among advisors and clients alike.

-

Co-Editing and Shared Access

Wealthbox empowers multiple advisors to simultaneously access and edit client data, ensuring real-time collaboration and eliminating the risk of data inconsistencies. This co-editing functionality allows advisors to share insights, provide feedback, and make informed decisions collectively, ultimately benefiting the client. -

Centralized Communication

Wealthbox serves as a central hub for client communication, consolidating emails, phone calls, and notes in a single, organized platform. This centralized approach streamlines communication, reduces the risk of miscommunication, and ensures that all team members are on the same page regarding client interactions. -

Task Management and Delegation

Effective collaboration hinges on efficient task management and delegation. Wealthbox offers robust task management capabilities, enabling advisors to assign tasks, set deadlines, and track progress. This functionality ensures that responsibilities are clearly defined, tasks are completed on time, and clients receive prompt and efficient service. -

Document Sharing and Co-Authoring

Wealthbox facilitates seamless document sharing and co-authoring, allowing advisors to collaborate on essential client documents, such as financial plans and investment proposals. This collaborative approach ensures that all relevant perspectives are considered, resulting in well-rounded and comprehensive client deliverables.

By fostering a collaborative environment, Wealthbox empowers financial advisors to work together synergistically, share knowledge, and provide exceptional service to their clients. The platform’s collaboration tools streamline communication, enhance efficiency, and promote teamwork, ultimately driving positive client outcomes.

Customization

Within the realm of client relationship management (CRM), customization plays a pivotal role in tailoring experiences to meet the unique needs and preferences of each client. Wealthbox, as a comprehensive CRM platform, empowers financial advisors with robust customization capabilities to elevate their client interactions and drive business growth.

-

Personalized Client Portals

Wealthbox enables advisors to create customized client portals, providing clients with secure access to their financial information, documents, and communication history. These portals can be tailored to each client’s specific preferences, ensuring a seamless and personalized user experience.

-

Automated Communication

Customization extends to automated communication, allowing advisors to create personalized email campaigns and marketing materials. By leveraging client-specific data, advisors can deliver highly relevant and targeted messages, enhancing engagement and nurturing relationships.

-

Tailored Reporting

Wealthbox offers customizable reporting capabilities, empowering advisors to generate reports that cater to the unique needs of each client. Advisors can select from a range of pre-defined templates or design their own, ensuring that clients receive the most relevant and meaningful information.

-

Customizable Dashboards

Wealthbox provides customizable dashboards that enable advisors to monitor key metrics and track progress towards client goals. These dashboards can be tailored to each advisor’s specific preferences, providing a personalized and efficient way to manage client relationships.

By harnessing the power of customization, Wealthbox empowers financial advisors to deliver exceptional and tailored experiences that meet the evolving needs of their clients. The platform’s comprehensive customization capabilities enable advisors to differentiate their services, strengthen relationships, and drive business success.

Security

In the realm of financial advice, security stands as a cornerstone, underpinning the trust that clients place in their advisors. Wealthbox recognizes this imperative, incorporating robust security measures to safeguard sensitive client data and ensure the privacy of financial information.

-

Data Encryption

Wealthbox employs industry-standard encryption protocols to protect client data both in transit and at rest. This encryption ensures that data remains secure, even in the event of a data breach.

-

Role-Based Access Control

Wealthbox implements role-based access control to restrict access to client data only to authorized personnel. This granular control ensures that client information is only accessible to those who need it to perform their job duties.

-

Two-Factor Authentication

Wealthbox utilizes two-factor authentication to provide an additional layer of security for user accounts. This requires users to provide two forms of identification, such as a password and a one-time code sent to their mobile device, when logging in.

-

Regular Security Audits

Wealthbox undergoes regular security audits conducted by independent third-party experts. These audits ensure that Wealthbox’s security measures are up to date and effective in protecting client data.

By prioritizing security, Wealthbox empowers financial advisors to focus on providing exceptional service to their clients, knowing that their data is safe and secure.

Integration

Integration plays a pivotal role within the wealth management ecosystem, enabling seamless connectivity between various applications and services. Wealthbox, a leading CRM platform for financial advisors, recognizes the importance of integration, offering robust capabilities to connect with a wide range of third-party tools and applications.

By leveraging Wealthbox’s integration capabilities, financial advisors can streamline their workflows, automate tasks, and enhance their overall productivity. For instance, advisors can integrate Wealthbox with their email marketing platform to automate email campaigns, track client engagement, and nurture relationships. Additionally, integration with accounting software allows advisors to import financial data directly into Wealthbox, saving time and reducing the risk of errors.

Moreover, Wealthbox’s open API architecture empowers developers to create custom integrations, tailored to specific advisor needs and preferences. This flexibility enables advisors to seamlessly integrate Wealthbox with their existing technology stack, ensuring a cohesive and efficient operational environment.

Support

Within the realm of wealth management, support stands as a cornerstone, underpinning the success and satisfaction of both financial advisors and their clients. Wealthbox, a leading CRM platform for financial advisors, recognizes the paramount importance of support, offering a comprehensive suite of resources and services to empower advisors in delivering exceptional client experiences.

Wealthbox’s support encompasses a wide range of offerings, including dedicated customer service, technical support, and educational resources. Advisors can access support via multiple channels, ensuring prompt and effective assistance whenever needed. The support team is comprised of knowledgeable and experienced professionals who are committed to resolving queries and providing guidance to advisors.

The practical significance of robust support cannot be overstated. Advisors can leverage Wealthbox’s support services to enhance their productivity, optimize their use of the platform, and stay abreast of the latest industry trends and best practices. By providing timely and reliable support, Wealthbox empowers advisors to focus on what matters most: delivering personalized and value-added services to their clients.

Frequently Asked Questions

This section addresses common inquiries and misconceptions surrounding “wealthbox” to provide a comprehensive understanding of its key aspects:

Question 1: What is the primary function of “wealthbox”?

Wealthbox serves as a cloud-based customer relationship management (CRM) platform tailored specifically for financial advisors. Its primary function is to assist advisors in managing client relationships, tracking investments, and facilitating business growth.

Question 2: How can “wealthbox” benefit financial advisors?

Wealthbox offers numerous benefits to financial advisors, including time savings, improved efficiency, and enhanced client service. It provides centralized access to client information, investment portfolios, and financial goals, enabling advisors to streamline their workflows and provide personalized advice.

Question 3: What sets “wealthbox” apart from other CRM platforms?

Wealthbox is specifically designed to meet the unique needs of financial advisors, offering industry-specific features such as investment tracking, performance monitoring, and marketing automation tools. It seamlessly integrates with other financial applications, enhancing the efficiency of advisors’ daily operations.

Question 4: How secure is client data within “wealthbox”?

Wealthbox places the utmost importance on security, employing robust measures to safeguard client data. It utilizes industry-standard encryption protocols, role-based access controls, and regular security audits to protect sensitive information and maintain compliance with regulatory requirements.

Question 5: Can “wealthbox” be customized to meet specific business needs?

Yes, wealthbox offers customizable features to cater to the unique requirements of financial advisors. Advisors can personalize client portals, automate communication, tailor reporting, and modify dashboards to align with their specific preferences and business practices.

Question 6: How does “wealthbox” support financial advisors in delivering exceptional client experiences?

Wealthbox empowers financial advisors to deliver exceptional client experiences through its comprehensive suite of tools and features. It facilitates efficient client management, personalized communication, and data-driven insights, enabling advisors to build strong relationships, provide tailored advice, and drive positive outcomes for their clients.

These FAQs provide a deeper understanding of “wealthbox” and its value proposition for financial advisors, highlighting its key functionalities, benefits, and commitment to security and customization.

Continue reading to explore additional aspects of “wealthbox” and its impact on the financial advisory industry.

Wealthbox Tips

Wealthbox, a leading customer relationship management (CRM) platform for financial advisors, offers a wealth of tips to help advisors optimize their use of the platform and enhance their client relationships.

Tip 1: Leverage Automation Features

Maximize efficiency by utilizing Wealthbox’s automation features, such as automated email campaigns, task assignments, and document management. This frees up valuable time, allowing advisors to focus on providing personalized advice to clients.

Tip 2: Personalize Client Interactions

Tailor interactions by leveraging Wealthbox’s customizable features. Create personalized client portals, automate communication based on client preferences, and generate customized reports to cater to specific needs, fostering stronger relationships.

Tip 3: Track Key Metrics and Monitor Progress

Stay informed about client activity and business performance by utilizing Wealthbox’s reporting and dashboard capabilities. Track key metrics, monitor progress towards goals, and identify areas for improvement, ensuring data-driven decision-making.

Tip 4: Leverage Integration Capabilities

Enhance productivity and streamline operations by integrating Wealthbox with other applications and services. Connect with accounting software, email marketing platforms, and financial planning tools to create a seamless and efficient workflow.

Tip 5: Utilize Educational Resources

Continuously improve knowledge and stay up-to-date with industry best practices by accessing Wealthbox’s educational resources. Participate in webinars, attend training sessions, and explore the wealth of online materials available.

Tip 6: Seek Support When Needed

Don’t hesitate to reach out to Wealthbox’s dedicated support team for assistance. Whether it’s technical support, guidance on platform features, or industry insights, the support team is available to help advisors succeed.

Tip 7: Leverage the Community

Connect with fellow Wealthbox users through online forums and user groups. Share knowledge, exchange best practices, and learn from the experiences of other advisors, fostering a sense of community and continuous improvement.

Tip 8: Stay Informed about Updates and Enhancements

Wealthbox is continuously evolving to meet the changing needs of financial advisors. Stay informed about the latest updates, feature enhancements, and industry trends by subscribing to newsletters, attending webinars, and regularly checking the Wealthbox website.

By following these tips, financial advisors can unlock the full potential of Wealthbox, enhancing their efficiency, personalizing client interactions, and driving business growth.

Conclusion

Wealthbox has emerged as a leading customer relationship management (CRM) platform, empowering financial advisors to streamline operations, enhance client engagement, and drive business growth. Its comprehensive suite of features, including client management, investment tracking, marketing automation, reporting, and collaboration tools, provides a holistic solution for managing client relationships effectively.

By leveraging the power of Wealthbox, financial advisors can unlock new possibilities, differentiate their services, and deliver exceptional client experiences. Through its commitment to security, customization, integration, and support, Wealthbox positions advisors for success in the ever-evolving financial landscape. As the industry continues to embrace technology, Wealthbox will undoubtedly remain an indispensable tool for financial advisors seeking to thrive and deliver unparalleled value to their clients.